Elite Webstores Team

Why Multi-PSP Strategies Are the Game-Changer for Scaling E-Commerce Businesses

Picture this: It's Black Friday, 3 PM Eastern Time. Your e-commerce site is humming with activity when suddenly—disaster strikes. Your single payment provider goes down for "routine maintenance" that was supposed to happen at midnight. In the next two hours, you lose $50,000 in sales while frantically calling customer support and watching competitors capture your traffic.

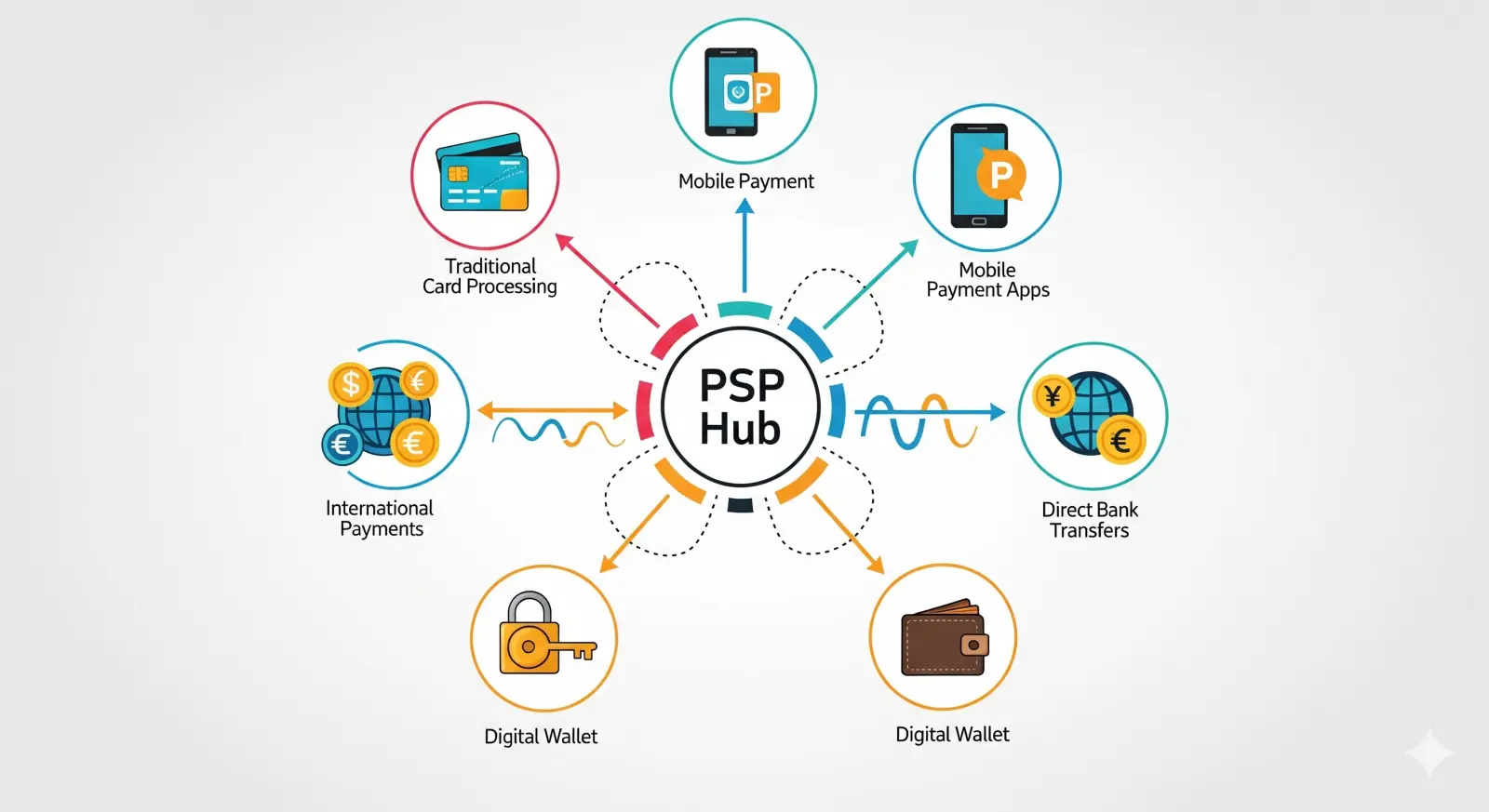

Sound familiar? If you're running an e-commerce business on a single Payment Service Provider (PSP), you're essentially playing Russian roulette with your revenue. The businesses that scale successfully in today's competitive landscape aren't the ones with the best products—they're the ones with the most resilient payment infrastructure.

The Hidden Costs of Single-PSP Dependence

Here's a sobering reality: Payment failures cost businesses globally $20.3 billion every year. Even more alarming? 40% of consumers abandon their purchase when a payment fails, and 33% won't try again. When your entire payment infrastructure depends on one provider, you're essentially putting all your eggs in one very fragile basket.

Let me share what happened to Maria Sanchez, owner of Riverside Bakery. When COVID-19 forced her business online, she initially set up with just cash and credit card options through a single PSP. She quickly discovered that customers who preferred digital wallets, Buy Now Pay Later (BNPL) options, or alternative payment methods simply went elsewhere. The result? She was losing 47% of potential customers who shopped elsewhere when their preferred payment method wasn't available.

The Numbers Don't Lie

Payment failure rates average between 5-10% worldwide, but here's what most business owners don't realize: these failures compound exponentially when you're locked into a single provider. Research shows that businesses with integrated payment gateways see a 20% increase in conversion rates, but those gains are meaningless if your single provider has a bad day.

The Multi-PSP Advantage: Five Game-Changing Benefits

1. Bulletproof Reliability Through Strategic Redundancy

When one gateway experiences issues, intelligent routing automatically switches to your backup provider in milliseconds. Merchants using two or more gateways see up to 12-15 percentage point increases in successful authorizations during peak sales compared to single-gateway competitors.

Consider the 2023 Visa processing outage that hit Eastern Seaboard retailers. Businesses accepting only card payments saw transactions drop by 67%, while those with diversified payment options experienced just a 28% reduction—preserving thousands of dollars in revenue during just a six-hour disruption.

2. Global Reach Without Geographic Barriers

90% of cross-border shoppers will abandon a purchase if local payment options are missing. Different regions have vastly different payment preferences:

- China: 78% prefer digital payment methods

- Germany: 80% of transactions are still cash-based

- Sweden: Only 13% use cash for transactions

- Europe: Digital wallets are the top choice for online shopping

A multi-PSP strategy lets you offer locally preferred payment methods without massive infrastructure investments.

3. Cost Optimization Through Competitive Routing

Competitive routing can cut blended processing fees by up to 8%. Instead of being locked into your single provider's rates, intelligent algorithms analyze factors like transaction size, currency, and provider fees to route each payment through the most cost-effective channel.

One IXOPAY customer discovered that 10-15% of their transactions would've been declined if they had only used one PSP. How would your revenue be impacted if your transaction approval rate increased by ten percentage points?

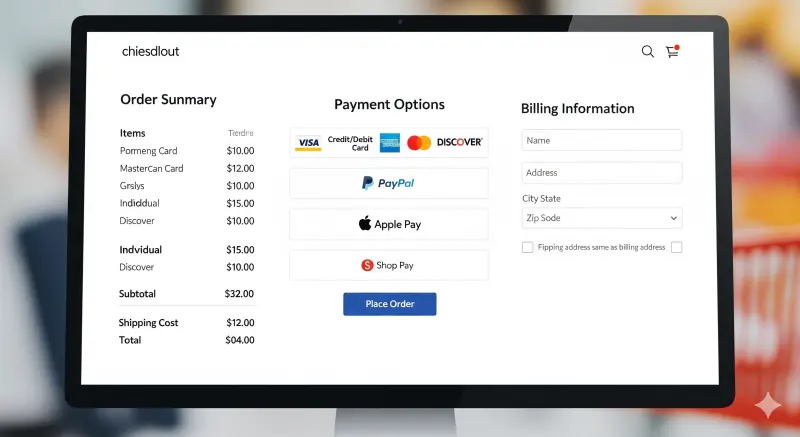

4. Enhanced Customer Experience

Conversion rates typically increase 25-30% when businesses add just two additional payment methods. Modern consumers expect options:

- 39% use credit cards for cross-border purchases

- 26% prefer digital wallets

- 23% use debit cards

The Buy Now, Pay Later (BNPL) market alone was valued at $39.65 billion in 2024, with customers who use BNPL increasing their average purchase value by 10%.

5. Business Continuity and Risk Mitigation

Each hour of payment downtime can cost large merchants $100,000+. Multi-PSP strategies provide essential failover capabilities, ensuring continuous payment processing even during provider outages, maintenance windows, or regional issues.

Real Success Stories: Multi-PSP in Action

Vinted: 4.15% Acceptance Rate Uplift

European marketplace Vinted partnered with multiple PSPs to enhance payment processes across Europe and the UK, achieving a 4.15% uplift in acceptance rates. For a marketplace processing thousands of transactions daily, this translates to millions in additional revenue.

THG Ingenuity: 4.6% Performance Boost

The e-commerce platform achieved a 4.6% acceptance rate uplift by implementing intelligent routing across multiple payment providers, demonstrating how even established platforms benefit from payment diversification.

Headout: 5% Higher Acceptance Rate

The travel booking platform saw a 5% higher acceptance rate through intelligent payment orchestration, crucial in an industry where booking abandonment is costly and customer acquisition expensive.

Step-by-Step Implementation Guide

Implementing a multi-PSP strategy doesn't have to be overwhelming. Here's your roadmap to payment resilience:

Phase 1: Assessment & Planning (Weeks 1-3)

- Audit current payment performance: Identify failure rates, declined transactions, and geographic gaps

- Analyze customer payment preferences: Survey your audience and review checkout analytics

- Set clear objectives: Define target improvements for acceptance rates, global reach, and cost reduction

- Select primary and secondary PSPs: Choose providers that complement each other's strengths

Phase 2: Primary Integration (Weeks 4-7)

- Implement payment orchestration platform: Choose between building in-house or using solutions like Stripe's multi-processor support or Checkout.com's ProcessOut integration

- Establish secure tokenization: Implement universal tokenization to seamlessly switch between PSPs without storing multiple sensitive data types

- Conduct thorough testing: Test all payment flows, failure scenarios, and edge cases

Phase 3: Secondary PSP Integration (Weeks 8-10)

- Integrate additional providers: Add regional specialists, local payment methods, and alternative payment options

- Configure intelligent routing rules: Set up algorithms based on geography, transaction type, card BIN, and historical success rates

- Implement fraud protection: Layer fraud detection across multiple providers for enhanced security

Phase 4: Routing Optimization (Weeks 10-12)

- Deploy machine learning algorithms: Use real-time data to optimize routing decisions automatically

- A/B test routing strategies: Compare performance across different routing logics

- Fine-tune based on data: Adjust rules based on actual performance metrics rather than assumptions

Phase 5: Monitoring & Refinement (Weeks 12-14)

- Establish KPI dashboards: Track acceptance rates, costs, customer satisfaction, and system uptime

- Implement continuous improvement: Regular review and optimization of routing rules

- Scale successful strategies: Apply learnings to new markets, product lines, or customer segments

Making the Business Case: ROI Calculations

Here's how to present the multi-PSP strategy to stakeholders:

Cost Savings:

- Processing fee reduction: 8% average savings through competitive routing

- Operational efficiency: 40-60% faster payment processing

- Reduced failed payment recovery costs: Up to $2.5M+ in annual savings

Revenue Protection:

- Prevented cart abandonment: 25-30% conversion rate increase

- Higher approval rates: 10-15% more successful transactions

- Global expansion readiness: Access to 140+ payment methods

Common Implementation Pitfalls (And How to Avoid Them)

1. Overcomplicating from Day One

Start with 2-3 well-chosen PSPs rather than trying to integrate every available provider. 51.3% of businesses still use only one PSP, so even modest diversification puts you ahead of most competitors.

2. Ignoring Regional Preferences

Don't assume global payment methods work everywhere. In Brazil, 95% of consumers prefer local payment methods. Research local preferences before expanding.

3. Neglecting Data Ownership

Ensure you own your payment data and customer relationships. Tokenization platforms enable businesses to maintain control without introducing additional PCI DSS compliance complexity.

4. Under-investing in Analytics

80% of businesses cite difficulty in pinpointing causes of failed payments. Implement robust reporting and analytics from day one to make data-driven optimization decisions.

The Future is Multi-PSP

The evidence is overwhelming: businesses offering at least four payment options experienced 15% higher annual growth than those with limited options. As the global e-commerce market grows to an expected $8.1 trillion by 2026, the absolute value of declined transactions will increase proportionally.

Alternative payment methods are projected to cover 360 billion e-commerce payments by 2029—about 69% of global e-commerce transactions. The question isn't whether to implement a multi-PSP strategy—it's how quickly you can get there before your competitors do.

Ready to Transform Your Payment Strategy?

Multi-PSP implementation might seem daunting, but the businesses that succeed in the next decade will be those that prioritize payment resilience and customer choice over simplicity and convenience. Every day you delay is potential revenue lost to competitors who've already made the switch.

Want to dive deeper into building your multi-PSP strategy? Join our free webinar "Payment Orchestration Masterclass: From Single PSP to Global Payment Leader" where we'll walk through live case studies, implementation frameworks, and answer your specific questions about scaling payment infrastructure.

The transformation from single-PSP dependence to multi-PSP mastery isn't just a technical upgrade—it's a competitive necessity. Your customers expect seamless, flexible payment experiences. Your business deserves resilient revenue protection. The multi-PSP advantage isn't coming—it's already here.

Register now and stop playing payment roulette with your business success.

Ready to scale your e-commerce payments infrastructure? Connect with our payment strategists to design your custom multi-PSP implementation roadmap.