Elite Webstores Team

The Psychology of Checkout: 7 Payment UX Principles That Increase Conversions by 35%

Over 60% of abandonment happens after items reach the cart—meaning your checkout flow, not your marketing funnel, is silently bleeding revenue.

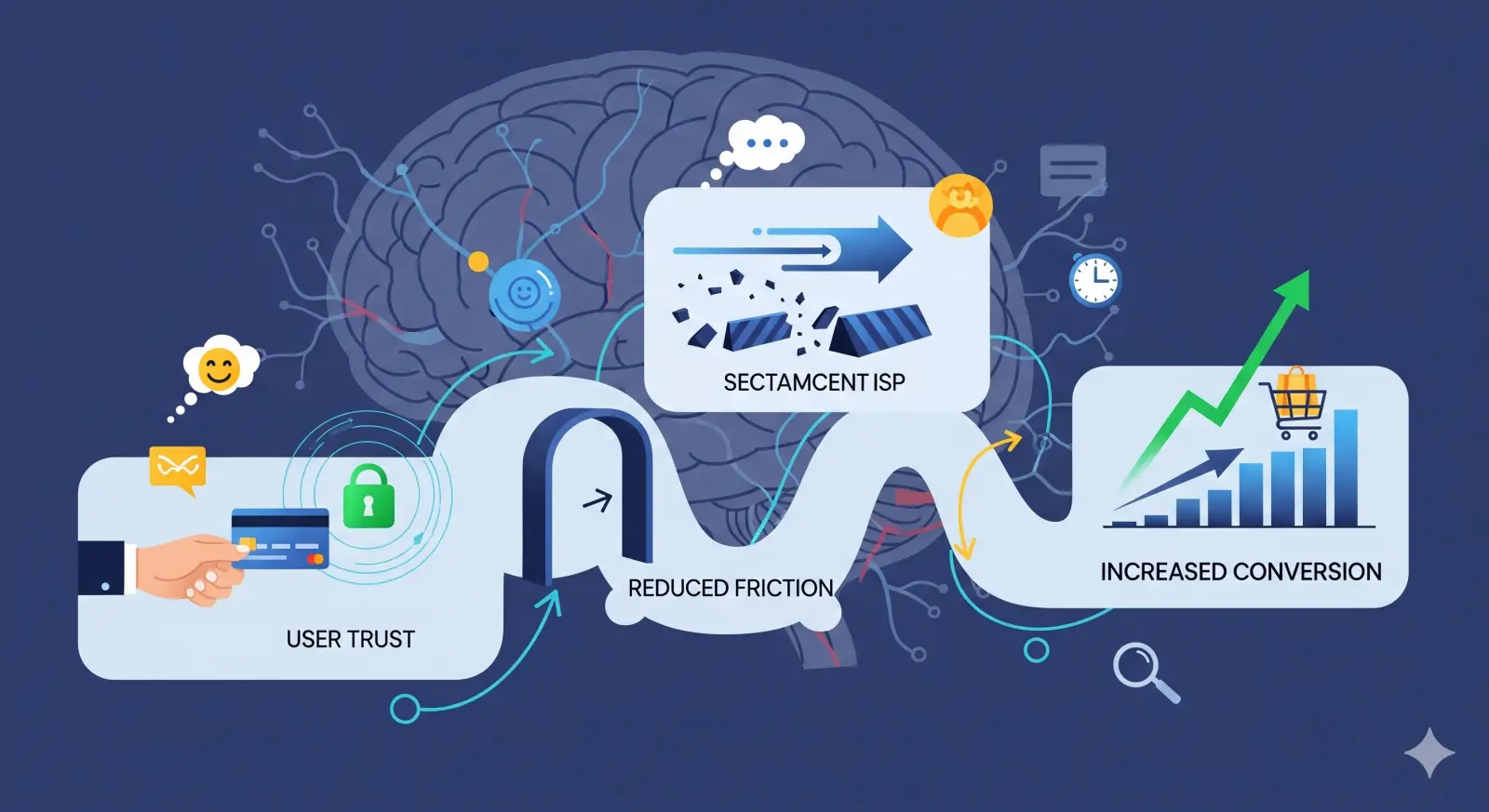

Human decision dynamics—risk aversion, cognitive load, social proof, speed expectation—drive checkout success. These 7 principles turn behavioral science into engineered payment uplift.

Snapshot: Principles & Potential Impact

Instead of a large comparison grid, here is a succinct impact digest:

- Guest Checkout (+5–15%) – Removes commitment barrier.

- Field Reduction (+3–10%) – Cuts cognitive micro‑cost.

- Trust & Clarity (+4–12%) – Reduces perceived risk; boosts follow‑through.

- Payment Method Fit (+5–18%) – Aligns with habitual preference.

- Progressive Disclosure (+2–6%) – Lowers overwhelm; keeps momentum.

- Mobile Ergonomics (+3–9%) – Thumb‑zone + single column.

- Stored / 1‑Click (+8–20%) – Converts intent into habit.

1. Offer Guest Checkout (Default)

Forcing account creation is a commitment barrier. Offer guest first; defer account pitch until success screen.

Common anti‑patterns & quick fixes:

- Forced registration → Add primary “Checkout as Guest” CTA.

- Hidden account‑free link → Promote to button parity.

2. Ruthlessly Remove Fields

Audit every field: Does it fulfill, reconcile, or mitigate risk? If not—eliminate.

Frequent removals: title/salutation, mandatory second address line, domestic phone, manual card type selection (auto‑detect BIN). Collapse optional extras behind a link.

3. Build Trust with Signals & Predictability

Four compact levers: (1) Real security / scheme badges proximate to pay button; (2) Transparent total cost early (tax + shipping); (3) Persistent brand mark for familiarity continuity; (4) Reassurance microcopy (“We never store raw card data. All transactions are encrypted.”).

4. Offer Payment Method Fit

Map segments to necessity:

- Subscription SaaS: Card + wallet + SEPA Direct Debit for churn resilience.

- Gen Z / Mobile: Apple / Google Pay for device trust + biometric ease.

- EU Regional: iDEAL, Sofort, Bancontact for cultural default preference.

- LATAM: Pix / Boleto bridging cash + instant bank rails.

5. Progressive Disclosure

Reveal complexity only when signaled. Examples: link to “Add apartment / suite”, expandable “Add VAT / GST number”, inline validation for real‑time corrections. Keeps first impression lightweight.

6. Mobile-First Ergonomics

Single column, large tap targets (≥44px height), optional sticky order summary (collapsible), and primary CTA positioned within natural thumb reach (lower center). Avoid dual-column layouts.

7. Stored & One-Click Payments

Tokenized wallets + network tokens raise repeat speed & approval resilience. Provide one‑click reorder (prefill last successful basket) and set smart default to last successful method.

KPI Dashboard (Conversion Health)

| KPI | Target | Why |

|---|---|---|

| Checkout Completion Rate | +> 5pp QoQ | Core success metric |

| Avg Fields Completed | < 10 | Friction indicator |

| Wallet Payment Share | > 35% mobile | Speed & trust adoption |

| Auth Success Rate | > 95% domestic | Revenue efficiency |

| Repeat Purchase % | > 28% | Loyalty & stored payment value |

Implementation Roadmap (12 Weeks)

| Phase | Weeks | Focus | Outcomes |

|---|---|---|---|

| Audit | 1–2 | Field + flow audit | Removal backlog |

| Quick Wins | 3–5 | Guest + wallet + trust | Early uplift |

| Structural | 6–9 | Progressive disclosure + mobile | Reduced friction |

| Optimization | 10–12 | A/B & personalization | Incremental gains |

Experiment Backlog Starters

- A/B: Guest CTA primary vs secondary

- Auto-focus first field vs no auto-focus

- Sticky pay button vs static

- Wallet buttons top vs bottom of flow

Repurposing Ideas

LinkedIn thread ("7 UX Wins") • Short video (Wallet adoption) • Infographic (Field removal matrix) • Webinar (Checkout Psychology) • Downloadable “Checkout Audit Template”.

Need a conversion uplift audit or orchestration upgrade? Contact us →