Elite Webstores Team

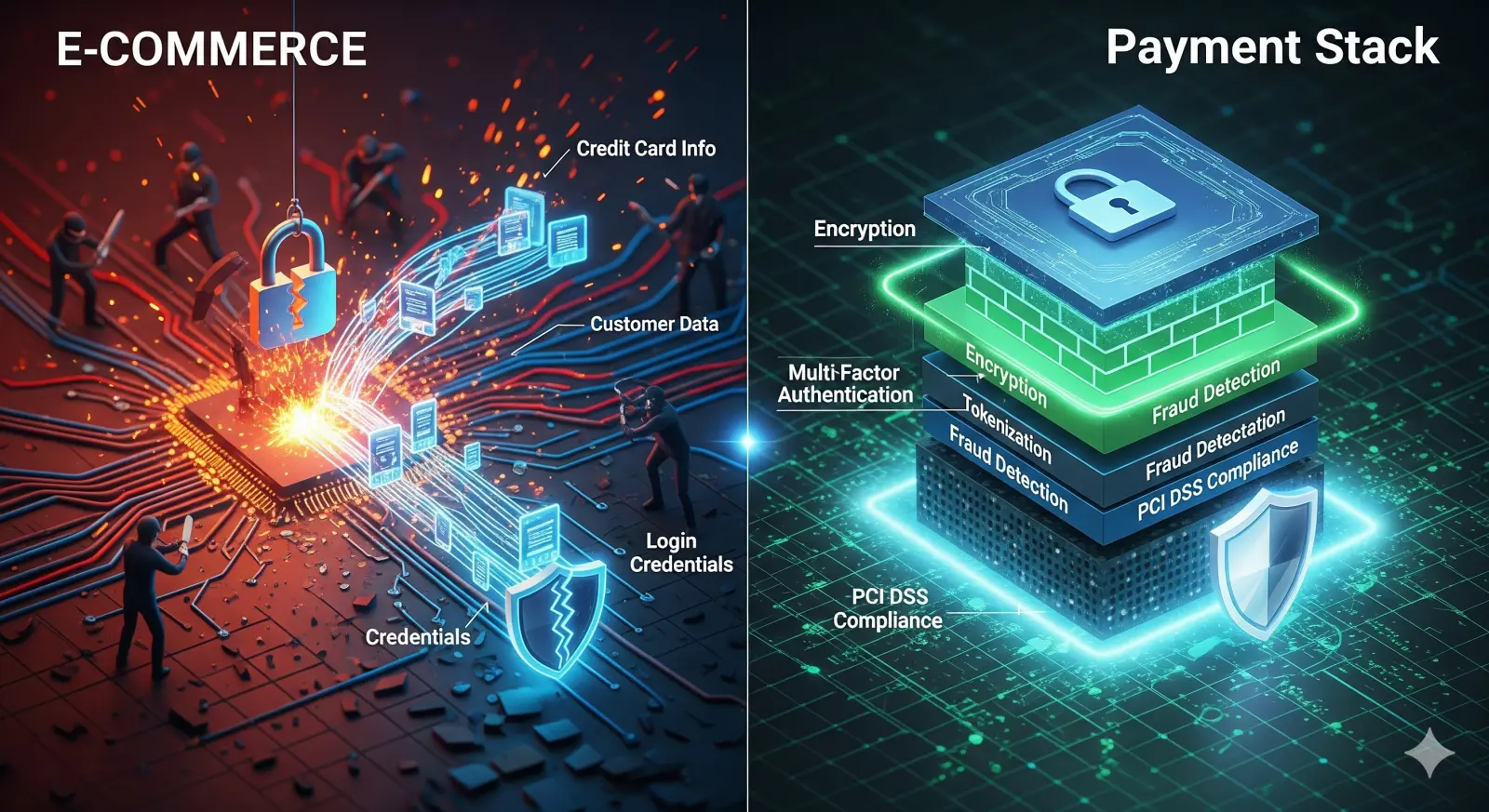

E-Commerce Security Breaches: Lessons Learned and How to Fortify Your Payment Stack

Average time to detect a payment data exposure in 2025: 41 days. Compress that to hours and you convert existential risk into manageable incident response.

Security failures today: less about brute force, more about supply chain scripts, credential stuffing automation, misconfigured cloud resources, and vulnerable third-party SDKs.

Breach Pattern Snapshot (2025)

| Pattern | Description | Impact Vector | Lesson |

|---|---|---|---|

| Magecart 4.0 | Obfuscated injection via tag manager fallback | Skims PAN + CVV silently | Strict CSP + subresource integrity |

| Credential Stuffing 2.0 | Tooling with human-like pacing + residential proxies | Account takeover → stored methods abuse | Device fingerprint + velocity anomaly models |

| Token Replay | Intercepted session or weak JWT handling | Fraudulent post-auth charges | Short-lived tokens + audience binding |

| Misconfigured Buckets | Exposed logs containing partial PAN or tokens | Data exfil / compliance fines | Automated config scanners |

| Dependency Supply Chain | Compromised NPM package updates | Skimmer or backdoor | Pin + integrity verify + provenance checks |

Root Cause Themes

- Excessive implicit trust in script supply chain.

- Siloed logging (slow correlation across PSP + app + CDN).

- Weak secret rotation practices.

- Over-permissive IAM roles for build / deploy bots.

Defense-in-Depth Blueprint

- Data Minimization: Never store raw PAN—use PSP tokens only.

- Tokenization Strategy: Vault with multi-PSP portability (avoid closed ecosystems).

- Encryption-in-Transit: Enforce TLS 1.2+, HSTS, OCSP stapling.

- Client Integrity: CSP (script-src nonce), SRI hashes, dependency allowlist.

- API Security: mTLS or signed requests for internal payment microservices.

- Secrets Hygiene: Automated rotation (KMS) + no shared human accounts.

- Observability: Unified event pipeline—auth declines, risk flags, chargebacks.

- Anomaly Detection: Baselines on auth rate, BIN mix, latency, geographic skew.

- Access Control: Least privilege IAM; ephemeral build credentials.

- Incident Runbooks: Tested tabletop exercises—timed metrics (MTTD, MTTR).

PSP Angle

| PSP | Built-In Security | Merchant Responsibility | Quick Action |

|---|---|---|---|

| Stripe | PCI Level 1, Radar, network tokenization | Secure webhooks + secret rotation | Verify webhook signatures everywhere |

| Checkout.com | Advanced fraud + routing controls | Event logging + custom risk signals | Stream events to SIEM for correlation |

| PayPal | Buyer + seller protection tooling | Front-end integrity + recovery flows | Monitor dispute reason trends |

| Worldpay | Fraud screening + token vault | Access governance + replay defense | Audit token scope + retention |

Monitoring Playbook

Narrative: Stream PSP webhooks + app logs + WAF events into central lake. Define golden signals: auth rate drop >80 bps in 10m, surge in BIN region anomaly, spike in 3DS challenges, rise in JavaScript errors on checkout page. Trigger on-call + auto snapshot of active scripts + config state.

Metrics & Thresholds

| Metric | Normalized Target | Alert Threshold |

|---|---|---|

| Mean Auth Rate | >94% (core markets) | -0.8% in 15m window |

| Fraud Loss % GMV | <0.15% | >0.25% rolling 7d |

| ATO Incidents / 1k Logins | <0.4 | >1.0 |

| Sensitive Log Artifacts | 0 leaked | >0 occurrence |

| Time to Revoke Leaked Key | <30 min | >45 min |

Incident Response Snapshot

- Contain: Disable compromised keys / rotate tokens.

- Eradicate: Patch exploited component / remove malicious script.

- Recover: Re-enable services behind WAF rules + staged traffic.

- Notify: Legal, PSPs, affected users (jurisdiction timelines).

- Post-Mortem: Blameless analysis + control gap fixes.

Common Anti-Patterns

| Anti-Pattern | Risk | Fix |

|---|---|---|

| Single PSP Dependency | Outage or targeted fraud amplifies impact | Add second PSP + orchestrated failover |

| Logging PII in Full | Regulatory + breach blast radius | Mask + hash selective fields |

| Long-Lived API Keys | Escalation window | Rotate + scoped ephemeral tokens |

| Manual Config Drift | Hidden insecure states | GitOps + policy as code |

Checklist

- CSP + SRI enforced

- Unified event ingestion active

- Token portability validated

- Secret rotation automation deployed

- Second PSP routing tested

- Incident tabletop completed in last quarter

Where Elite Webstores Helps

We harden payment platforms: token migration plans, multi-PSP orchestration, observability pipelines, and security governance frameworks.

Need a security posture uplift? Contact us or review Services.

Make attackers work harder than your competitors do. Fortify now →